Average tax deduction per paycheck

That means that your net pay will be 43041 per year or 3587 per month. Therefore the total amount of taxes paid annually would be 4403.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

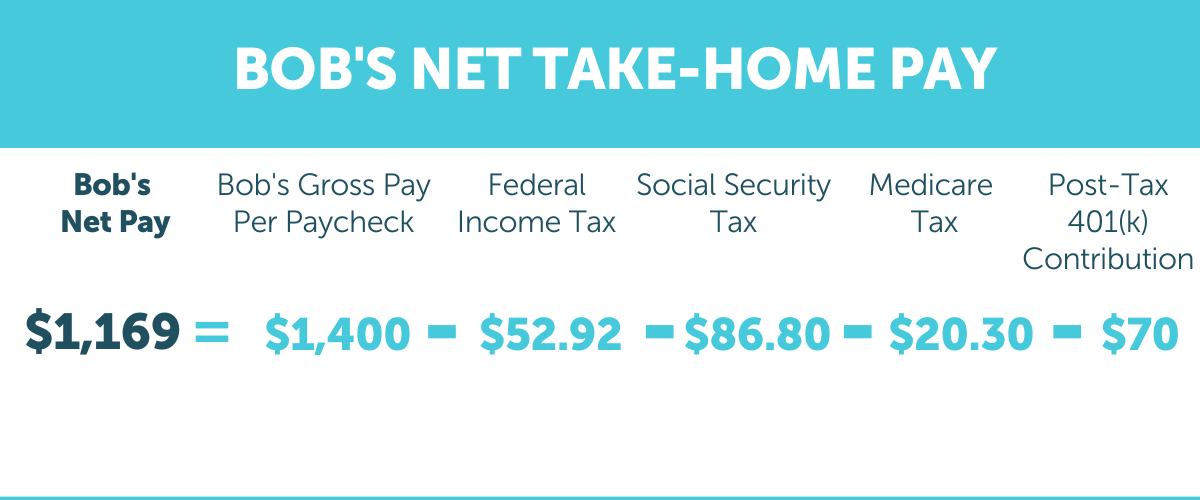

See where that hard-earned money goes - Federal Income Tax Social Security and.

. Learn More at AARP. Your effective tax rate is just under 14 but you are in the 22. Advance Child Tax Credit.

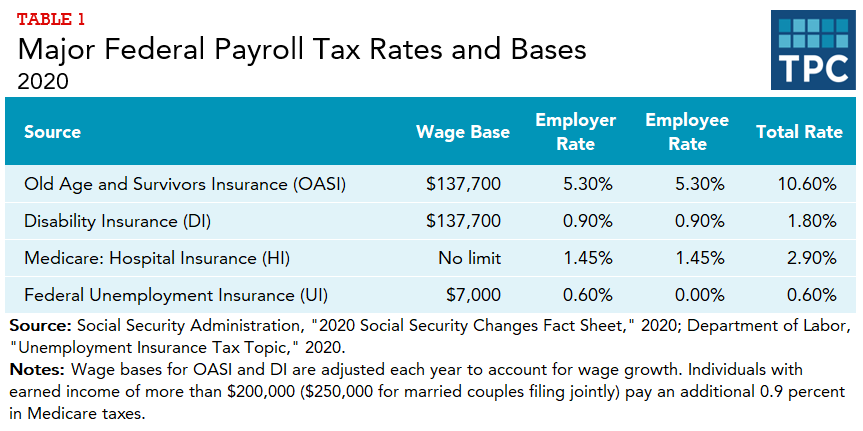

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Indexed brackets and other provisions to the Chained Consumer Price Index C-CPI measure of inflation including the standard deduction which for 2020 stands at 12400. Ad Compare and Find the Best Paycheck Software in the Industry.

22 on the last 10526 231572. Some deductions from your paycheck are made. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Based on a survey of 2100 employees at non-federal public and private companies KFFs 2017 Employer Health Benefits Survey finds that the average worker pays. Can be used by salary earners self. If you make 200000 you will be taxed 95250 the 10 percent bracket plus 3501 the 12 percent bracket plus 9636 the 22 percent bracket plus 18000 the 24.

Choose From the Best Paycheck Companies Tailored To Your Needs. The average federal income tax payment in 2018 was 15322 according to the most recent data available from the IRS. The average marginal tax rate is 259 while the.

Your employer withholds a 62 Social Security tax and a. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Your average tax rate is.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. You pay the tax on only the first 147000 of your. Youd pay a total of 685860 in taxes on 50000 of income or 13717.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. This means the total percentage for tax deduction is 169. This is tax withholding.

Size of Adjusted Gross Income SOI Bulletin Historical Table 3. Number of Individual Income Tax Returns Income Exemptions and Deductions Tax and Average Tax. Terms apply to offers listed on this page.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

The IRS made notable updates to the. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

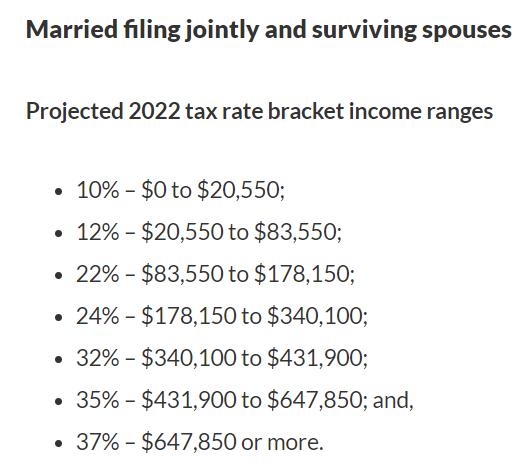

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

2022 Federal Payroll Tax Rates Abacus Payroll

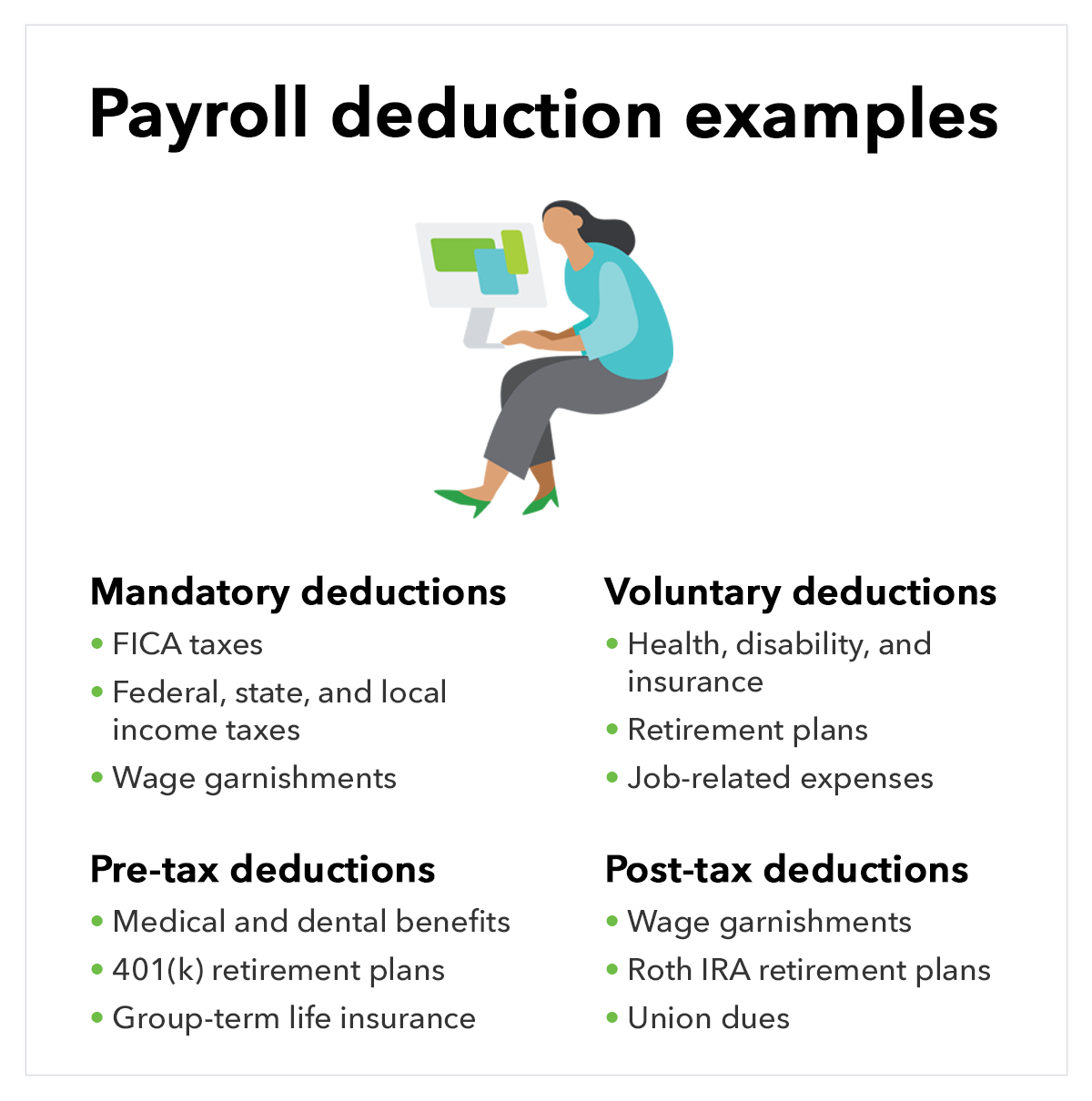

What Are Payroll Deductions Article

Are Charitable Payroll Deductions Allowed To Be Pretax

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Payroll Tax What It Is How To Calculate It Bench Accounting

2022 Federal State Payroll Tax Rates For Employers

Different Types Of Payroll Deductions Gusto

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

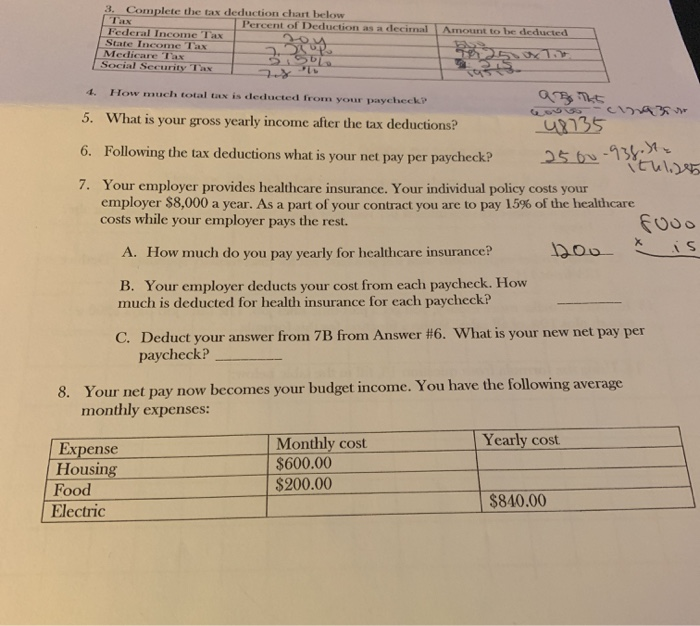

3 Complete The Tax Deduction Chart Below Percent Of Chegg Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

What Are Payroll Deductions Article